Difference Between Sale Deed and Agreement to Sell: Understanding the Legal Distinction

In the world of property transactions in Karnataka, and across India, two terms often cause confusion for buyers and sellers alike: the Sale Deed and the Agreement to Sell. While they may sound similar, they serve distinct legal purposes and have significant implications for ownership rights and liabilities. In this article, we’ll explore what each document entails, how they differ, and why understanding this distinction is essential for any property transaction.

What is an Agreement to Sell?

An Agreement to Sell is a preliminary contract between a property buyer and seller. It outlines the intention of both parties to enter into a future transaction under mutually agreed-upon terms. This agreement is governed by the Indian Contract Act, 1872, and is generally executed before the sale deed is drawn up.

Key Elements of an Agreement to Sell:

- Description of the property

- Agreed-upon sale price

- Payment terms and schedule

- Timeframe for completing the sale

- Conditions to be met before the sale deed is executed.

Importantly, this agreement does not transfer ownership of the property. It only establishes a future commitment to complete the sale.

What is a Sale Deed?

A Sale Deed is the final, legally binding document that completes the sale of a property. It transfers the title of the property from the seller to the buyer. In Karnataka, as in other Indian states, the sale deed must be registered with the jurisdictional Sub-Registrar’s Office under the Registration Act, 1908.

Key Elements of a Sale Deed:

- Details of the buyer and seller

- Full description of the property

- Agreed sale price and payment confirmation

- Transfer of ownership rights

- Confirmation that the property is free from encumbrances

Once registered, the sale deed becomes the ultimate legal proof of ownership.

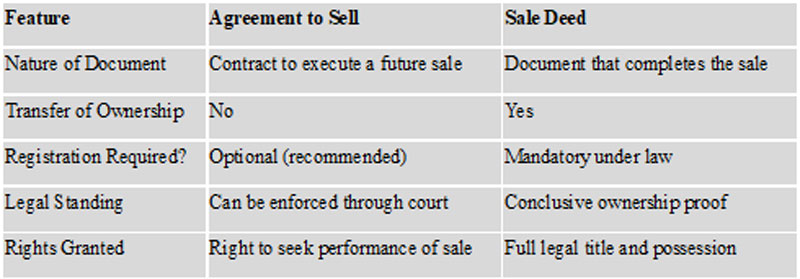

Major Differences Between the Two

Understanding this distinction is crucial for several reasons:

- Legal Security: If you’re a buyer, holding only an Agreement to Sell doesn’t make you the legal owner. You cannot sell the property, nor can you get building permissions or loans.

- Dispute Resolution: If the seller backs out after signing the Agreement to Sell, the buyer has the right to file a suit for specific performance. But this process can be long and costly.

- Bank Loan Processing: Financial institutions require a registered Sale Deed before disbursing the final loan amount. While some may accept the Agreement to Sell for pre-approval, ownership is not recognized until the sale deed is in place.

- Possession vs. Ownership: You may take possession of the property after signing an Agreement to Sell, especially in builder-buyer cases, but legal ownership still resides with the seller until the Sale Deed is executed.

Best Practices

- Always have both documents drafted or reviewed by a property lawyer.

- If entering into an Agreement to Sell, ensure all conditions precedent (like loan approvals or due diligence) are clearly defined.

- Ensure timely execution of the Sale Deed once conditions in the agreement are fulfilled.

- Never rely solely on an Agreement to Sell as proof of ownership. Ensure the Sale Deed is registered.

In a property transaction, the Agreement to Sell sets the stage, but the Sale Deed seals the deal. Buyers must ensure that the sale is completed through a properly executed and registered Sale Deed to enjoy full legal rights over the property. Ignoring this step can lead to ownership disputes, legal hassles, and financial losses.

When in doubt, always consult a qualified real estate lawyer to review your documents. A little legal foresight can go a long way in protecting your investment.